1. Introduction

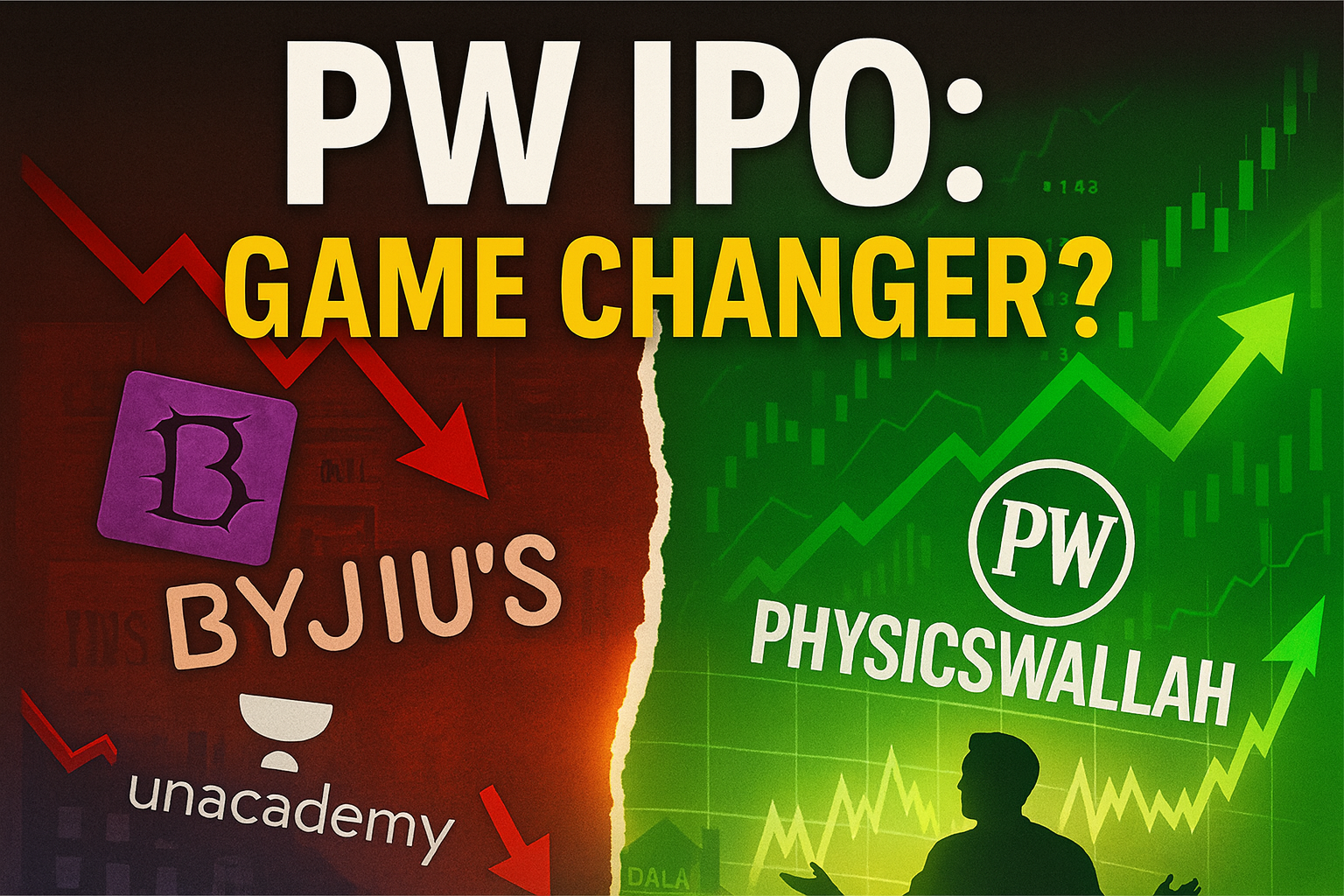

PhysicsWallah has become one of the most talked-about listings in India’s edtech space. What began as a humble YouTube channel has grown into a profitable, widely-recognised education platform. Its IPO marks a significant moment—not just for the company, but for the Indian education-technology sector as a whole. This article breaks down the company’s story, its financials, the IPO details, its strengths and risks, and whether you should keep it on your radar.

2. Company Overview

PhysicsWallah was founded by Alakh Pandey and Prateek Maheshwari. It started in 2016 as a YouTube channel teaching physics for JEE (Joint Entrance Examination) aspirants. By 2020, the operation had formally become a company and expanded to multi-subject content, test preparation (NEET, JEE, various boards), and also built offline-hybrid centres. Its mission: “to make high-quality education accessible & affordable” for students across India.

PhysicsWallah IPO: India’s EdTech Giant Hits the Public Markets

PhysicsWallah is currently one of the most talked-about IPOs in India’s edtech industry. The company started as a small YouTube channel and has now grown into a well-known education platform used by millions of students. Its IPO is an important moment not only for the company but also for the entire edtech sector in India.

In this article, we explain the journey of PhysicsWallah, its financial performance, the key details of its IPO, its strengths and challenges, and why this IPO is getting so much attention.

3. Growth Story

- From a simple YouTube channel to a large education firm: the brand built trust early by offering strong content at affordable pricing.

- Rapid growth in users, platforms, offline/online mix:

- As of 30th June 2025, they had ~13.7 million YouTube subscribers and ~4.5 million paid users; ~303 offline/hybrid centres including “Vidyapeeth”, “Pathshala” etc.

- They leveraged low customer-acquisition cost (CAC) by using their online following, then scaled offline centres to strengthen their hybrid model.

- In a tough edtech era (many firms facing losses), PhysicsWallah’s growth and brand gave it an edge.

4. Revenue Model & Business Verticals

PhysicsWallah earns revenue through a mix of channels:

- Online courses & subscriptions: test prep for JEE, NEET, board exams.

- Offline & hybrid coaching centres: these help capture the market beyond just online.

- Study-material, test series, doubt-solving, books: part of the integrated education ecosystem.

- Their model emphasises scalability: once content and brand are built, incremental students add high margin.

5. Why This IPO Matters

It’s one of the rare edtech firms in India going public while still growing rapidly and with a strong brand presence.

- The public issue helps fund the next phase of expansion—both online and offline.

- Marks investor sentiment shifting positively toward edtech again (after the tough years).

- Gives students/investors a window into the future of education in India (hybrid, affordable, scale-driven).

6. IPO Details (Key Facts)

Here are the key numbers for the IPO:

- Issue opened: 11 November 2025.

- Issue closed: 13 November 2025.

- Price band: ₹ 103 to ₹ 109 per share.

- Lot size: 137 shares (minimum investment approx ₹ 14,933) (for retail investor)

- Issue size: ~₹ 3,480 crore (₹ 34.8 billion) via fresh issue + offer-for-sale.

- Listing date: 18 November 2025.

- Listing performance: The shares opened at around ₹ 145 on NSE (~33% premium to issue price ₹ 109) and traded up to ~₹ 161.99 during debut.

- Valuation: At debut, company’s valuation crossed US $5 billion (~₹ 40,000+ crore) for a moment.

7. Strengths

- Strong brand & trust: Students know the name “PhysicsWallah”, especially from YouTube and test-prep ecosystems.

- Affordable pricing + large target market: Unlike premium edtech, they cater to mass-segment which gives room to grow.

- Hybrid model (online + offline): Helps in markets where internet penetration or preference for in-person still strong.

- High growth potential: With fresh capital, they can expand offline centres, newer courses (state boards, skill-based) and newer geographies.

- Momentum in listing: The market reacted positively, which adds credibility.

8. Risks & Challenges

- Profitability still an issue: Despite growth, they carry losses. For example, net loss widened from ~₹ 81 crore in FY23 to ~₹ 216 crore in FY25.

- Competition is fierce: Many large players (online, offline) could squeeze margins or increase marketing cost.

- Offline expansion cost & execution risk: Opening many centres is capital-intensive and managing quality is hard.

- Dependence on exam cycles: Their business is strongly tied to JEE/NEET/board exam aspirants; any regulatory or structural change in these can impact them.

- Scalability & retention: Getting new students is fine; retaining them, keeping costs low, and maintaining quality is harder.

- Macro risk for edtech: Investor sentiment, regulation on edtech fees, internet/data-access issues could play up.

9. Should You Watch This IPO?

- If you’re an investor interested in:

- Education sector (India)

- High-growth companies

- Brands with scale potential

then yes, PhysicsWallah is worth tracking.

However, investment should be after the IPO listing when more data becomes available (e.g., quarterly performance, how they execute offline scaling). Since losses exist, focus should be on whether they can turn growth into profits.

10. Conclusion

The PhysicsWallah IPO is more than just another listing—it signals the changing face of Indian education: digital + physical hybrid, affordable + scalable, mass-market + quality content. For the company, it opens the door to further expansion, stronger brand positioning, and investor scrutiny. For students and the sector, it could be a benchmark.

“Disclaimer: The information provided in this article is based on publicly available data and is meant for educational and informational purposes only. Investing in IPOs and stock markets carries risks, including potential loss of capital. Please verify all details independently and consult a certified financial advisor before making any investment decisions.”